The world’s first AI workspace built to

transform commercial real estate transactions

AI is not an add-on, it’s at the core of how Layron gives you a competitive edge in today’s fast-paced real estate market.

Stop wasting time on bad deals – Layron brings speed, precision, and AI-driven intelligence to every deal.

Book a Demo ->Let specially trained AI Agents take off cumbersome tasks from your to-do list and accomplish work in minutes that previously took days

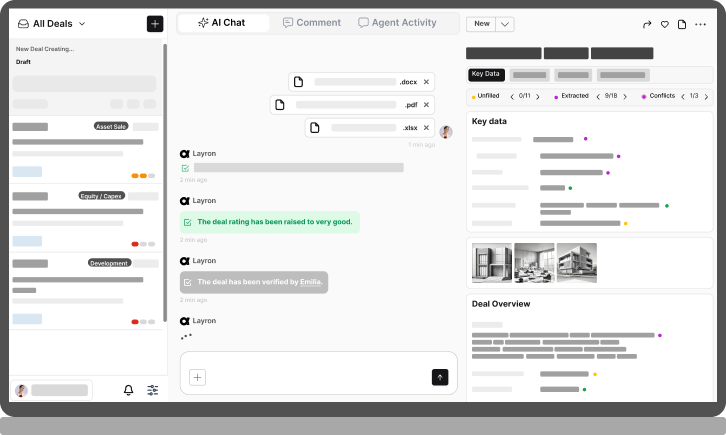

One dashboard tailored to your specific needs and preferences shows all deal components, AI activity, and progress. Intervene, approve, or redirect any process in real-time.

Download standardized outputs based on your own templates for internal and external stakeholders.

Access all past deals processed by Layron in one central place. Layron detects if a deal is already known.

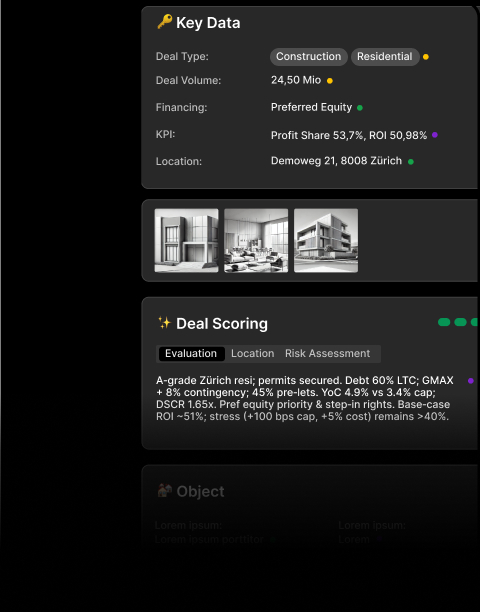

Layron analyzes every deal against your investment criteria. See instant scores, risk assessments, and recommendations tailored to your strategy.

AI analyzes thousands of pages in seconds and builds a deep understanding of the deal. All files are automatically sorted into the data room

Ask about anything buried in the documents. Get comprehensive answers instantly.

Get bankable deal structures automatically generated. AI creates financing scenarios, tests break points, and models returns for every stakeholder. Receive full sensitivity analyses and waterfall calculations ready for investor review.

Get automated performance insights across your pipeline. AI monitors deal flow and tracks the KPIs important to you.

Let AI match deals to investors automatically. See engagement analytics in real-time.

AI agents systematically work through rent rolls, leases, and financials. They surface risks, validate assumptions, and compile findings while your team focuses on the deal.

Each party sees exactly what they need. AI prepares and formats deal information for different audiences – interactive dashboards for analysts, fact sheets for investors, compliance packages for lenders, all permission-controlled with approval workflows

Layron handles hundreds of deals simultaneously while your entire team works without bottlenecks. The platform processes even hundrets of documents per deal in parallel, adapts to your unique workflows, and grows with your portfolio. Integrate it with your existing CRM, portfolio management systems, and private and public data providers through APIs. Receive real-time deal flows from email inboxes, and other sources like your website – all feeding into your deal pipeline automatically.

Full explainability is built into every workflow. Each AI output links directly to source materials with highlighted excerpts showing exactly where information originated. Layron maintains comprehensive logs of all activities – from document ingestion to final recommendations. No matter who performed the action. Performance dashboards display system KPIs, user activity metrics, and processing statistics configured during setup. Every calculation, every flag, every score traces back to specific inputs. Your compliance team sees the complete chain of reasoning, ensuring total accountability across all automated processes.

AI agents operate within guardrailed workflows defined by your standard operating procedures. Every process follows pre-configured approval hierarchies – routine tasks proceed automatically while high-value decisions trigger human review. Layron distinguishes between authorization levels, escalating to appropriate stakeholders based on deal size, risk thresholds, or exception criteria. Outputs follow standardized templates ensuring consistency across all transactions. Multiple validation checkpoints verify accuracy before any document reaches your team. The result: predictable, repeatable processes that deliver institutional-grade reliability every time.

Enterprise security without compromise. Full GDPR compliance with automated data governance, right-to-deletion protocols, and privacy-by-design architecture. Your sensitive deal data never leaves designated EU servers, never trains AI models, never crosses borders without explicit permission. Advanced encryption protects documents end-to-end while SSO and role-based access control secure user authentication. Regular third-party penetration tests validate security posture. Choose exact data residency – from Swiss banking-grade facilities to German high-security centers. Complete data sovereignty with ISO 27001 standards ensuring your confidential transactions remain exactly that: confidential.

Real estate and private market transactions are slow, fragmented, and inefficient. A team of industry experts, AI engineers, and UX specialists set out to change that.

By employing AI at every stage – from deal sourcing to due diligence – we replace slow, complex workflows with almost real-time execution. A seamless, frictionless interface maximizes efficiency, eliminates frustration, and makes this new workspace indispensable.

With cutting-edge technology and deep expertise, we’re not just improving deal execution – we’re here to redefine how private markets operate.

Michael Bischof

Chief Executive Officer

Marc Clapasson

Chief Growth Officer

Kurt Praszl

Head of Investment

Robert Ponta

Chief Technology Officer